In France, the high price of demand response services is rising sharply: a mirror of the anticipated imbalance on the electrical system

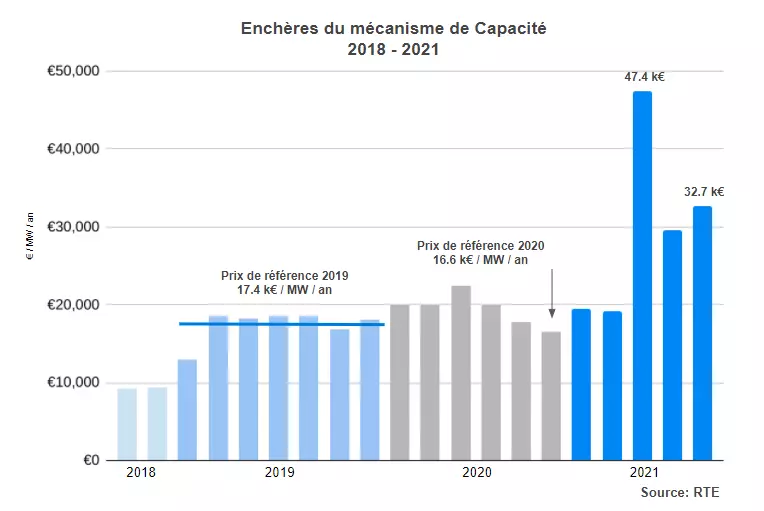

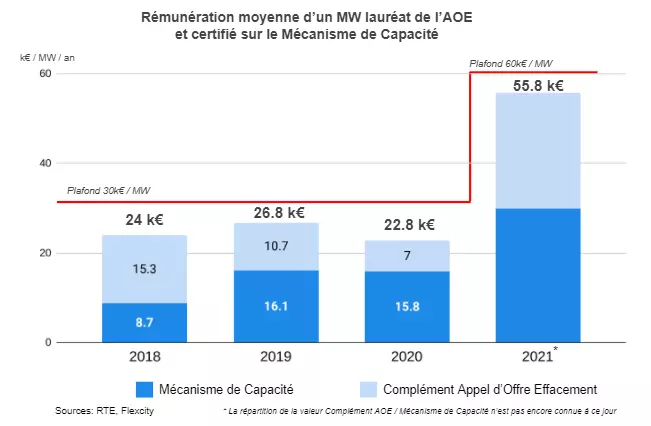

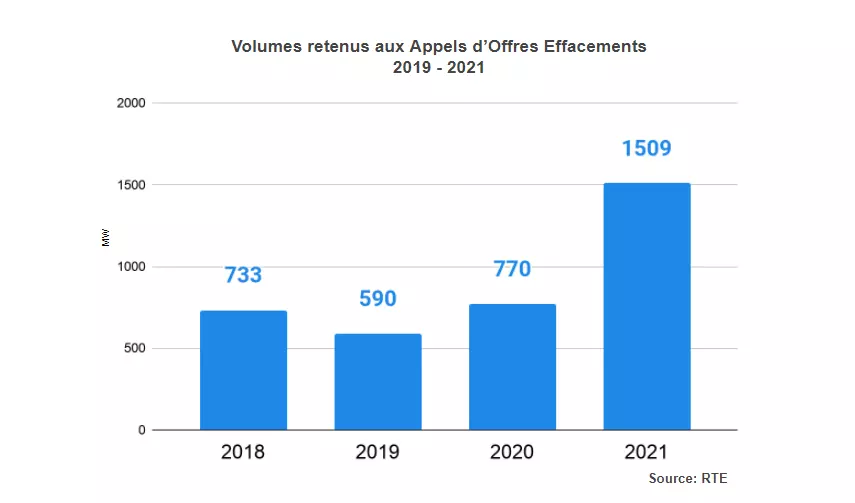

The last three Capacity auctions and the 2021 “Appel d’Offre Effacement” Tender Offer have reached historically high levels in recent months, which are precursors of the short-term imbalance of the French power system but also proof that this market is now recognised for its true usefulness.

The capacity mechanism aims to ensure the security of electricity supply in France during winter peak periods by ensuring that generation and load shedding capacities are adequate to consumption.

The COVID - again - and in particular the lock down have caused delays in the schedule of maintenance operations planned for the nuclear power plants in the spring and have led EDF to lower its production forecasts to historically low levels in April 2020.

This announcement of a drop in nuclear production caused worries on the balance between supply and demand for electricity anticipated for the winter of 2020/2021, while assumptions of a rapid economic recovery were imagined.

Last June, the Minister for Ecological and Solidarity Transition announced a series of exceptional measures to contribute to the balance of the electricity grid in order to mitigate the "clear trend towards a global deficit above the 2 GW threshold". Above this threshold, the penalty applied to prices of negative deviations on the capacity mechanism is set at a ceiling of €60K/MW (instead of the classic formula: PREC x 1.2).

What are the implications for the Capacity 2020 and 2021 market?

In the wake of this mobilisation at the highest level of government, the June 2020 capacity market auction has soared to €45K/MW for 2020 and €47K/MW for 2021.

The last capacity market auction of 15 October 2020 continues to reflect this anticipated tension on the supply-demand balance and in particular for 2020 since the price approached the price cap of €60K/MW (€53.6K/year for 2020).

The price of 2021 capacity, for its part, remains above the €30K/MW (€32.7K/MW) mark, despite announcements of improvements in the availability of EDF's nuclear plants and the level of the capacity obligation revised downwards.

What are the consequences on the 2021 “Appel d’Offre Effacement” Tender?

Last Friday 16th October, the “Appel d’Offre Effacement” Call for Tenders, reserved for "green" capacities and whose doubling of the ceiling had been one of the measures announced in June, saw its remuneration reach €55.8K/MW for the year 2021 against €23K/MW for 2020.

The volume selected is also up sharply with 1509MW, nearly double last year's figure. However, this volume will have to be adjusted for the capacities selected in the interruptibility tender (400MW) which will not be able to participate in the 2 mechanisms.

What behaviour to adopt?

The price levels seen on the various flexibility markets in recent months are a reflection of an electricity network that is showing signs of feverishness with the arrival of winter.

This situation may present as many risks as opportunities for all electricity consumers.

It is worth remaining vigilant, monitoring certain external factors (sanitary situation, weather, etc.) and adopting proactive behaviour.

Flexcity is at your disposal to share its market vision and to help you express the flexibility of your sites in the best possible way.

Join us to contribute to the energy transition & take advantage of new revenue opportunities.

Find out more:

- Press release of the Ministry of Ecological Transition in French

- Updated forecasts of RTE's security of supply in French